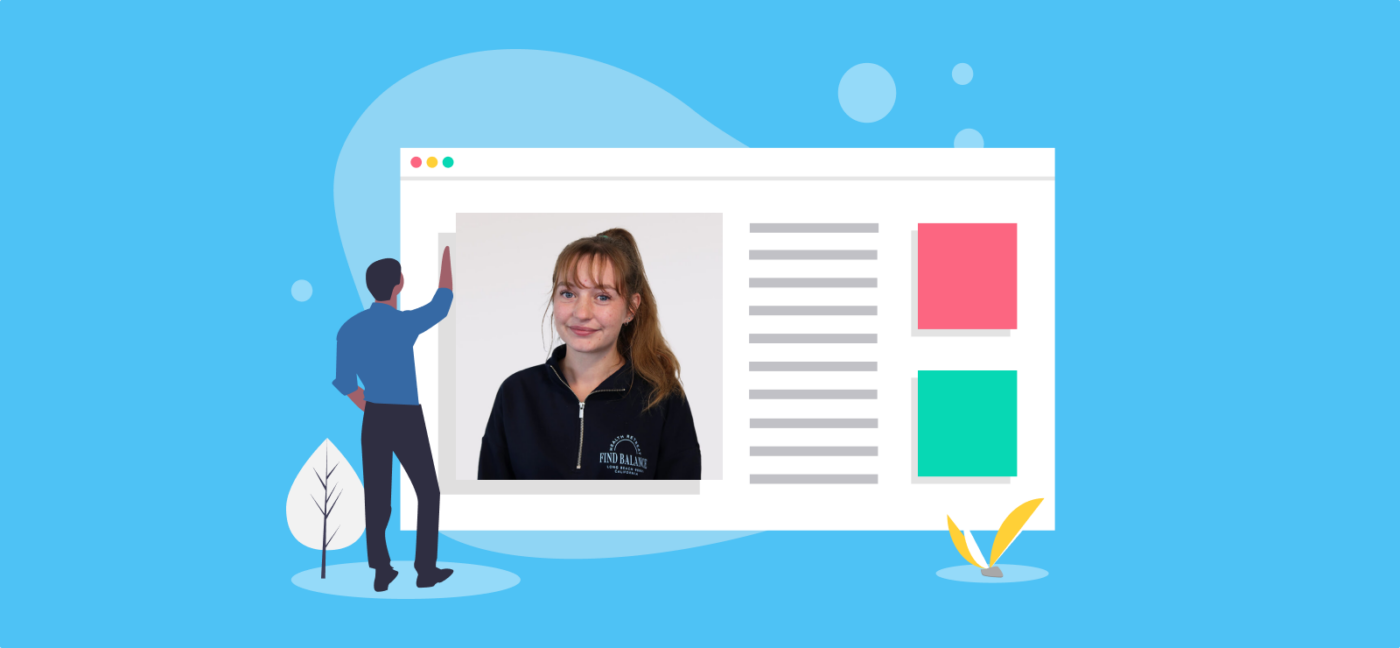

Staff Spotlight: Lauren Goodfellow, Payroll/Admin Assistant

Give an overview of the duties, functions and responsibilities of your job.

My job consists of answering clients’ emails and phone calls, and forwarding client post, as well as requesting agent authorisation, processing codes, calling clients to help them with the onboarding process, reassignments, and some payroll duties.

What particular challenges do you regularly encounter?

The long wait time on the phone to speak to HMRC.

What is your favourite part of the job?

My favourite part of the job is seeing the office dogs when they come into work 🐶

What do you like most about working for The Accountancy Partnership?

Everyone is really friendly. There are also lots of perks like staff nights out and pancakes on pancake day, it’s a nice working environment.

What skills do you find most useful to do your job?

The most useful skill for my job is time management. We have a lot of different tasks we have to do so ensuring you can get them all done in the day is important.

Where’s your favourite place to visit on days off?

My favourite place to visit on my days off is Chester Zoo, and also going out for food with my family and friends.

How would you colleagues describe you?

I asked my colleagues how they would describe me and they said the human form of an angel 💖. They also mentioned that I am the queen of pranks!

What are you reading/binge watching at the moment?

I am currently watching This Is Us and crying at every episode.

What question would you really like to answer, and what’s the answer?!

Are you excited to see Taylor Swift at the Eras tour? ABSOLUTELY

Find out more about the services we offer by hitting the live chat button, or get an instant quote online. Interested in joining the team? Check out our recruitment page!

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

May 2025 Client of the Month: ECN Music

28th May 2025This month we spoke to Nadja von Massow, Managing Partner of ECN Music! ECN Music | Facebook | Instagram | LinkedIn Hey Nadja! Tell…

Read More

Employed or Self-Employed; which is better?

27th May 2025Being your own boss is hard work, but it can also be extremely rewarding. That being said, running a business isn’t for…

Read More

Top Tax Breaks for Businesses

20th May 2025Claiming every bit of tax relief possible can noticeably reduce your tax bill, so you can put what’s left to better use…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.