What Digital Platform Reporting Rules Mean for Your Side Hustle

Digital platforms such as Etsy, Airbnb, and Uber are required to collect information about the money their users earn selling goods and services. HMRC have been able to request this information in the past, but the digital platform reporting rules mean platforms must submit this information regularly, rather than waiting to be asked.

What is a digital platform?

For these purposes, a digital platform includes software, websites, online marketplaces, and apps which connect sellers to other users in order to supply goods and services.

Who is affected by the digital platform reporting rules?

The new rules set out to minimise the risk of tax avoidance in sellers who use digital platforms to provide goods and services, such as:

- Private hire services and taxi drivers

- Food delivery networks

- Freelancers

- Short-term accommodation lettings

- Tangible goods sold through an online marketplace

Anyone who earns an income through a digital platform, whether you’re renting out your driveway or selling homemade badges on Etsy, might have their sales data passed on to HMRC.

The measures aren’t just restricted to the UK either. HMRC have confirmed that data will be shared with other tax authorities so if you’re UK based and sell overseas, or if you’re overseas and selling to the UK, this could still affect you.

Platforms won’t need to report ‘occasional’ sellers who, for these purposes, are classed as:

- Making fewer than 30 sales

- Receiving no more than €2,000

Will HMRC know if I earn money online?

The digital platform reporting rules mean that the app or website you use to sell services or goods must report what you earn from them – if the volume of sales or the amount you receive meets the criteria above.

What will HMRC do with that information?

HMRC will collate the data reported by each platform and match it to the correct taxpayer. You might find some platforms ask for additional information to enable this, such as your UTR number or documents (like a passport) so they can verify your identity.

Do I still need to send a tax return?

Yes, even though most digital platforms will now be responsible for informing HMRC about the money you earn from them, the usual rules about tax returns still apply.

If you’re registered to submit Self Assessment tax returns, or need to register, you should carry on as normal unless your situation changes (in which case, remember to tell HMRC!).

Will I pay tax if I sell my old clothes online?

The short answer is ‘maybe’. If you’re selling clothes online and worried about tax, and you receive more than £1,000 of untaxed income from self-employment, property or ‘miscellaneous’ income in a tax year (6th April – 5th April) then you’re required to register for Self Assessment and submit tax returns.

It’s important to keep a record even if you don’t think you need to submit anything. If you make 3 sales and receive £1,100 then the platform might not automatically share your details to HMRC, but you will technically be over the threshold for tax registration.

Does this affect the trading allowance?

No, the digital reporting rules won’t change any tax relief or allowances that you’re entitled to. For example, if your total self-employed earnings are less than the £1,000 trading allowance in a tax year (6th April to 5th April), then you won’t need to register for Self Assessment or submit a tax return.

You should also continue to claim tax relief on any allowable expenses that you might have.

How will I know what the platform told HMRC?

The platform will be required to provide a copy of any data it sends to HMRC about you, but keep a very careful eye on the dates covered by the reporting period:

- Platforms will report their data based on a calendar year (1st January – 31st December)

- People who submit a Self Assessment tax return usually report their finances on a tax year basis (6th April – 5th April)

What will I need to do?

The new digital platform reporting rules don’t impact your responsibilities around recording and reporting on your income – these stay the same. That said, it’s even more crucial that you:

- Are meticulous about recording earnings and expenses in your bookkeeping

- Sign up for Self Assessment if you need to

- Report your income figures accurately

Learn more about our online accounting services for businesses. Call 020 3355 4047 to chat to the team, and get an instant online quote.

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

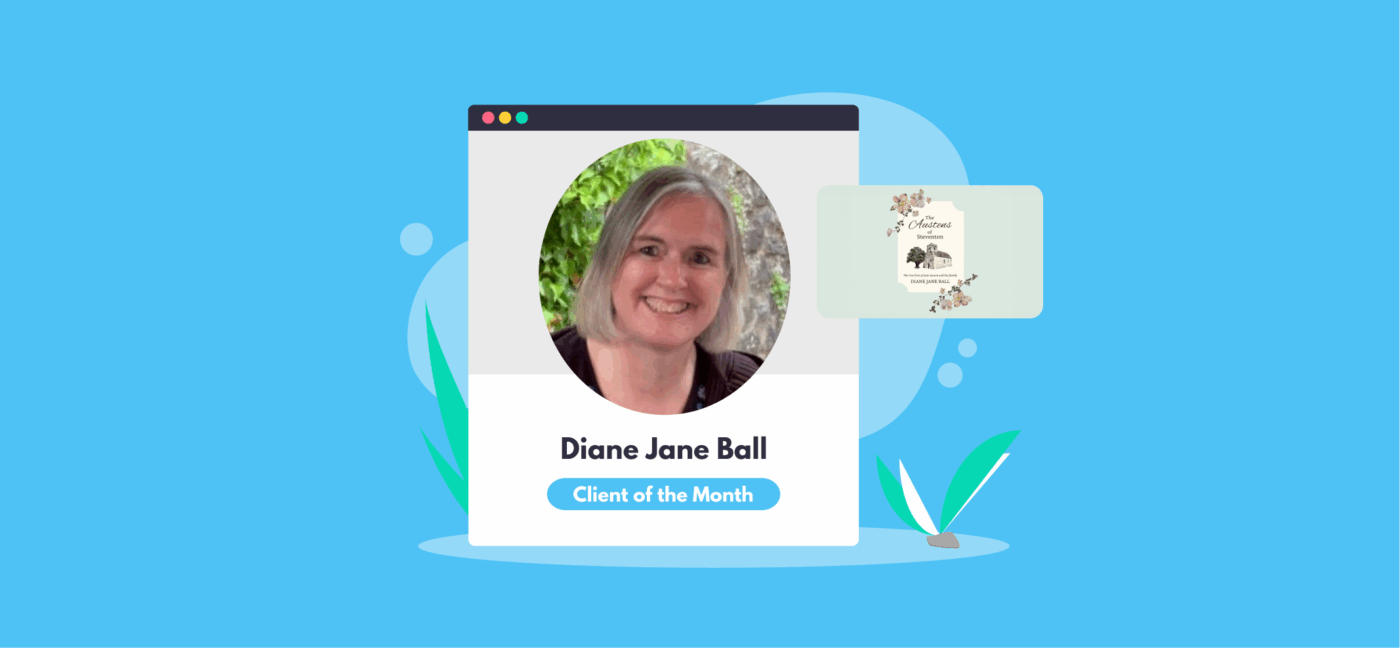

September 2025 Client of the Month: Diane Jane Ball

30th September 2025This month we spoke to Diane, self-employed English tutor and self-published author. Diane Jane Ball | Facebook | Goodreads Hey Diane! Tell…

Read More

The Accountancy Partnership – Our Positive Reviews

15th September 2025We’re proud of our customer reviews here at The Accountancy Partnership The reviews we receive from our customers show how hard we…

Read More

Earning 50k After Tax: Take Home Pay in the UK

9th September 2025£50,000 sounds like a good salary, but after you’ve paid Income Tax, National Insurance Contributions, and a percentage towards your pension –…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.