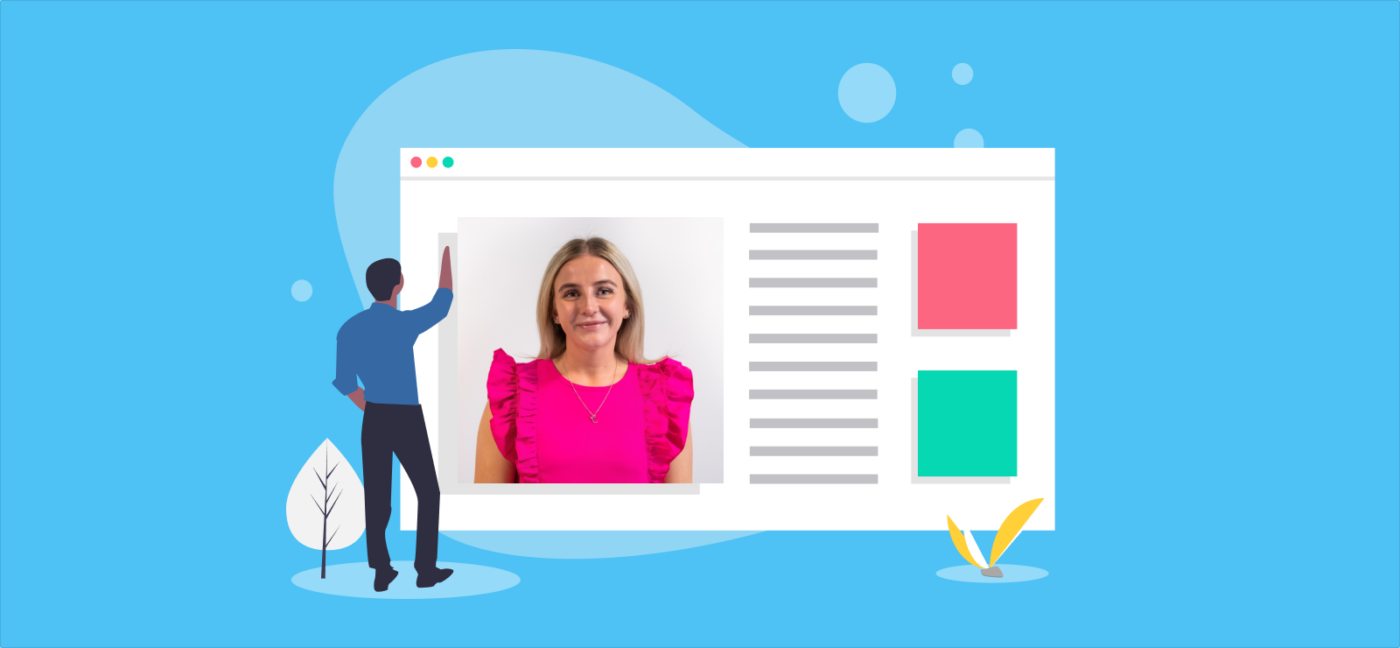

Staff Spotlight: Chloe Rhodes, Payroll Clerk

This month we spoke to Chloe Rhodes, Payroll Clerk at The Accountancy Partnership!

Give an overview of the duties, functions and responsibilities of your job.

- Setting up and running payrolls

- Submitting pensions

- Dealing with HMRC

What is a typical working day like for you?

Having just progressed to my new role as a Payroll Clerk I am looking forward learning more about Payroll, dealing with my own clients, and running their payrolls and pensions.

What are some of the biggest challenges faced by your clients?

A lot of the clients are new and need support and guidance at the beginning of setting their payroll up. I try to ensure everything goes smoothly and they understand how it works, especially with regards to HMRC guidelines.

How are you able to use your skills to solve problems for them?

I have recently finished my CIPP (Chartered Institute of Payroll Professionals) qualification which enabled me to get all the information needed to support our clients and ensure their payrolls are operated correctly.

What is your favourite part of the job?

Each day is different and I am constantly learning new things! We have a really supportive team in Payroll and are always helping each other out.

What do you like most about working for The Accountancy Partnership?

Dogs in the office, it brings a happier workplace! – Oh and my team, of course…

Where’s your favourite place to visit on days off?

Anywhere in nature with my dogs – anywhere from a field to hiking up mountains!

How would your colleagues describe you?

Apparently, I’m extremely trendy in my crocs.

What are you reading/binge watching at the moment?

Outer Banks

Who do you admire, and why?

My Mum and Nan, they are strongest people I know and I will forever be grateful to them both for making me the person I am today.

What question would you really like to answer, and what’s the answer?!

Do you want to book a holiday? Always!!

Find out more about the services we offer by hitting the live chat button, or get an instant quote online. Interested in joining the team? Check out our recruitment page!

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

April 2024 Client of the Month: Pro-Logist ltd

23rd April 2024This month we spoke to Silvia, Managing Director of Pro-Logist ltd! Pro-Logist ltd | LinkedIn Hey Silvia! Tell us about your business Pro-Logist,…

Read More

The Self-Employed Guide to Retirement Planning

19th April 2024Pension planning is often something we forget about until later in life, but the earlier you think about it, the better. Everyone…

Read More

14 Accountancy Terms Explained for Startups

17th April 2024Starting a business can be complicated enough, especially with all the new lingo that crops up along the way. In this article…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.