What Do Employers and Businesses Need to Know About the Kickstart Job Scheme?

Learn more about who the Kickstart Scheme is for, how to employ young people through it, and what you need to know about funding.

Who is the Kickstart Scheme for?

The Kickstart Scheme is a grant to encourage employers to create 6-month job placements for young people. The funding comes under the government’s Plan for Jobs, as part of the coronavirus economic recovery plan. It sets out to help tackle the downward effect which the coronavirus pandemic has had on employment opportunities.

The scheme targets younger people, who are less likely to have work experience and so might find it more difficult to find work. It funds employers who set-up 6-month paid placements to help eligible young people learn employable skills and gain experience.

Funding is available for companies and charities (the application process for the scheme asks for either a Companies House or a Charity Commission number). Public sector organisations and exempt charities can also apply for funding.

How much funding is available with a Kickstart Scheme grant?

The Kickstart grant gives funding to employers in two ways: help with salary costs, and support for other costs such as training.

Salary costs

The funding for each placement covers a National Minimum Wage salary for up to 25 hours per week, for 6 months. You can choose to pay more on top of this, or offer longer hours if you want to.

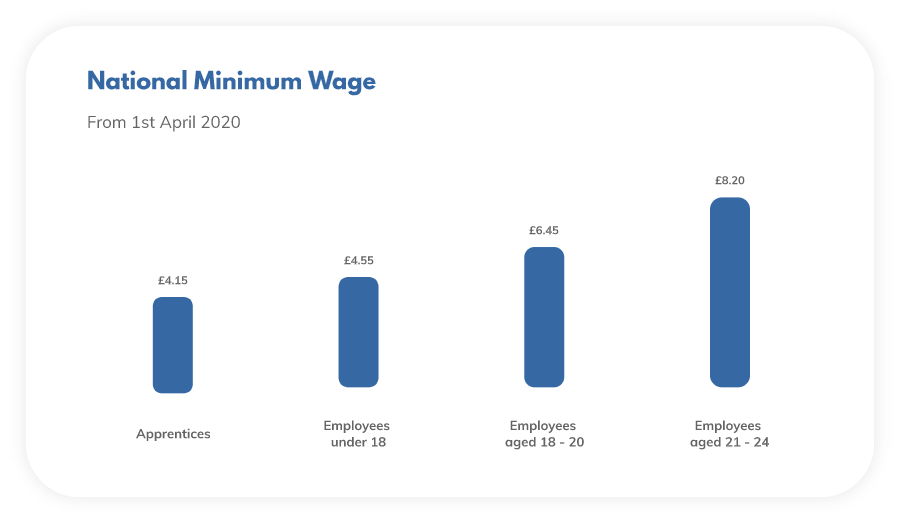

The rate of National Minimum Wage that must be paid depends on the age of the employee. Because Kickstart funding is for employees aged 16-24, the actual amount that an employer receives might vary depending on the candidate they employ.

As well as funding the salary costs, the Kickstart Scheme includes employer’s contributions for National Insurance and workplace pensions.

Employers normally pay Class 1A and 1B National Insurance at a rate of 13.8% on salary payments which are above the threshold of £169 per week. Employers only make contributions on the part of the salary which is above the threshold.

Class 1A and 1B National Insurance thresholds and rates for employers 2020/21

| Weekly Threshold 2020/21 | Annual Threshold 2020/21 | ||

| Secondary Threshold | Employers pay NICs at a rate of 13.8% on salary payments above this threshold. | £169 | £8,788 |

The Kickstart Scheme does include funding for Employers’ NI for the duration of the 6-month placement.

If you decide to continue employing the worker at the end of the placement, and these are some of your first employees, you may also be interested in learning more about a type of relief called Employment Allowance.

The Employment Allowance enables eligible employers to claim up to £4,000 of relief towards the costs of employers’ National Insurance.

Set-up and training costs

The scheme also provides employers with an additional £1,500 for each job placement. This is to help with the cost of setup, or to enable employers to provide additional training and support during the placement.

Are there restrictions on who I can offer a placement to?

The scheme aims to support young people who are at risk of being unemployed on a long-term basis. It means that you’re only able to offer placements to people who are:

- Aged 16 – 24 years old.

- Who are currently claiming Universal Credit.

- And are participating in the Kickstart Scheme (rather than recruiting someone by advertising the position).

What sort of role can I offer to a Kickstarter?

The scheme is open to any employer, in any industry. The placements must be new roles which have been created especially for the scheme, and not take work away from existing (or planned) employees or contractors.

It’s also worth keeping in mind that the purpose of the scheme is to help young people become more employable. Your application will need to show how the job role that you’re offering will support this aim. This includes helping them learn more about preparing for an interview, and how to prepare a CV and application.

This does mean that candidates are likely to have very little work experience. Entry-level and training roles are likely to be a good fit. Just remember that the role can’t be for anything which requires extensive training before starting the placement.

Our top tip? It’s a big commitment. Even though the government are funding the financial costs of the placements, make sure you have enough time and resources to support people on their placement with you.

How can I help participants learn new skills?

There are lots of ways to help your Kickstarter placement learn new skills. Though funding is awarded on the understanding that the role includes elements of CV-writing and interview prep, it’s up to you how to deliver training and provide experience.

You’ll be expected to explain how you plan to achieve this in your application, but could include:

- Kickstarters shadowing existing employees to learn more about their role.

- More formal mentoring.

- Training sessions.

- Online training, or providing training manuals and guides.

- Seminars for participants to talk to each other about their experiences.

How do I apply for Kickstart Scheme funding?

The way that you apply for a grant through the scheme depends on how many placements you are able to offer by yourself.

Applying directly

Each funding application must be for a minimum of 30 job placements. If you can offer 30 or more placements on your own, then you can apply for the Kickstart Scheme online.

You’ll need to provide the details of your organisation, as well as providing information about the job placements that you intend to offer. It’s important that you can demonstrate that these are newly created positions, and the support you’ll be able to give to those placed with you.

Applying with another organisation

Fortunately there are still other options, even if you can’t offer the minimum 30 placements by yourself.

- You could join forces with other employers to be able to offer the minimum 30 placements. One of you will need to act as the group’s representative, and take responsibility for submitting the funding application.

- Local organisations such as trade bodies or your local authority might decide to become representatives. You can talk to an employer contact for the Kickstart Scheme to find out if there is a group in your area.

How do I become a Kickstart Scheme representative?

Becoming a representative means that you will be responsible for a group application for Kickstart funding. During the grant application process you will be assessed in your suitability as a representative.

You’ll need to be able to prove that you have existing experience of managing these kinds of partnerships. Because of the responsibility involved, you will also need to be able to show that there are rigorous processes in place for dealing with the financial and administrative aspects of it.

If you’re acting as a representative for a group of employers you can request an additional £300 of funding to go towards your admin costs for doing so.

When does the scheme start?

Applications for the Kickstart Scheme are now open. You can apply online here.

What happens after applying for Kickstart funding?

There is no right of appeal if your application for funding is turned down, but there are no restrictions on how many times you can apply, either. If your application is refused, you will be given feedback which explains why, so that you know what to work on.

If your application for Kickstart Scheme funding is successful then you will be notified with the grant agreement. Once you have agreed the document and returned it, you’ll be contacted by candidates who have been matched to the role. We explain this process in more detail in the next section.

How do I take someone on under the Kickstart Scheme?

Employers will only receive the funding if they recruit someone through the scheme.

You can highlight the fact that you are supporting the scheme, but shouldn’t take applications directly. Instead, employers must supply a job description for each placement once their funding application has been successful. (But yes, you will need them to make the application for funding, too!)

The scheme matches suitable applicants to the role from a pool of participants, and invites them to contact the employer.

You’ll still be able to shortlist and interview candidates though, and you’re free to make your own selection about who to hire for the placement.

When will I receive my Kickstart Scheme grant?

The Kickstart grant is paid to employers in arrears. This means that the Department for Work and Pensions will check the PAYE information you provide to HMRC every time you pay your placement, and use it to reimburse you.

You’ll be paid for any initial costs once you have given confirmation that the placement has started, and that the person is setup on your payroll and through PAYE.

If these are your first employees and you would like to know more about PAYE, use our guide to learn more. If we look after your payroll, remember to let us know about your new starter!

Can I keep my Kickstarter on as an employee?

There’s no requirement to take them on at the end of the placement, but if you wanted to, then absolutely! The scheme aims to help participants become more employable, so you could offer an ongoing role if you wanted to. The funding is only available for the duration of the 6-month placement though.

Your employee could also begin an apprenticeship after the 6-month placement, or leave the scheme early to start one. There is already government funding in place for employers who take on an apprentice. Learn more about employing an apprentice and available funding.

Where can I get help with the Kickstart Scheme?

The scheme is managed through the Department of Work and Pensions. If you operate in a single region, you should email the employer contact for that area. Employers who operate across multiple regions can talk to the national employer contact. View the list of employer contact regions and email addresses.

Find out more about the help available for businesses dealing with the impact of coronavirus in our COVID-19 support hub for businesses. To talk to one of the team about our online accountancy services, call 020 3355 4047, use the live chat button, or request a call back.

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

Top Tax Breaks for Businesses

20th May 2025Claiming every bit of tax relief possible can noticeably reduce your tax bill, so you can put what’s left to better use…

Read More

The Accountancy Partnership – Our Positive Reviews

19th May 2025We’re proud of our customer reviews here at The Accountancy Partnership The reviews we receive from our customers show how hard we…

Read More

Making Money on TikTok

13th May 2025In today’s increasingly (some would even say chronically) online world, where there’s a constant battle for people’s attention, it’s not just a…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.