Blog

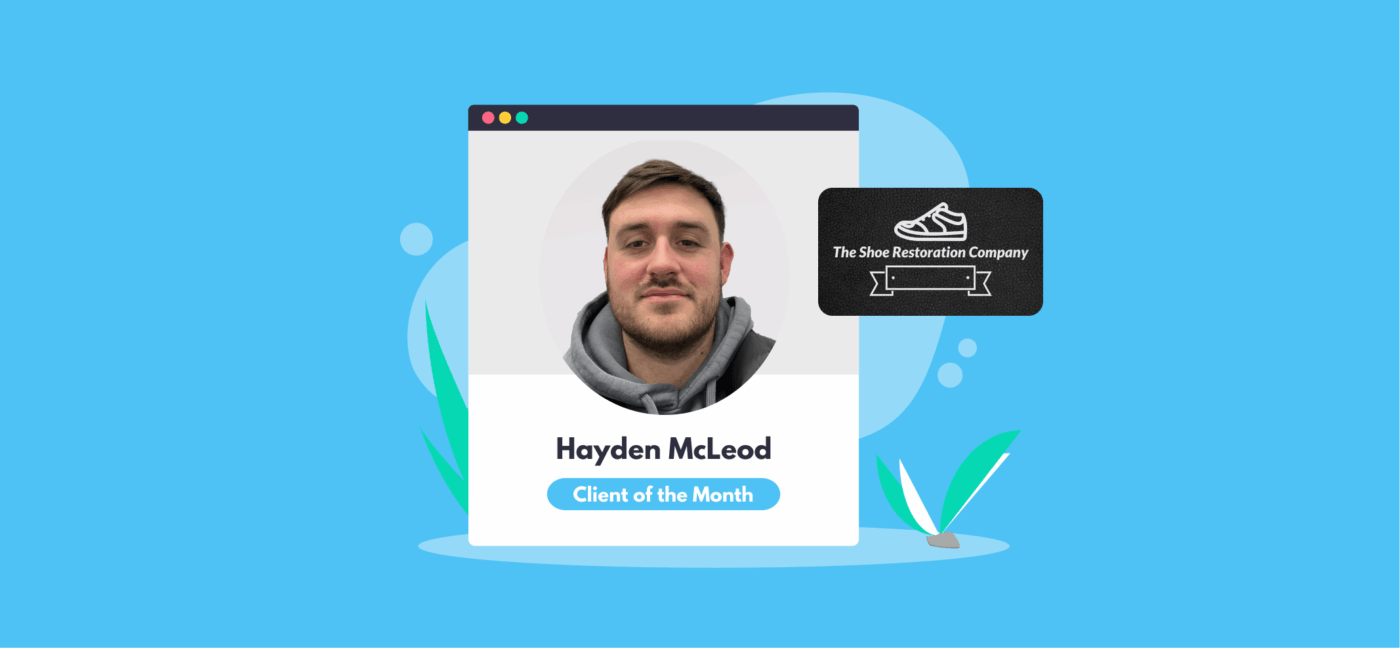

August 2025 Client of the Month: The Shoe Restoration Company

1st September 2025This month we spoke to Hayden, founder of The Shoe Restoration Company. The Shoe Restoration Company | Facebook | Instagram Hey Hayden!…

Read More

The Accountancy Partnership – Our Positive Reviews

18th August 2025We’re proud of our customer reviews here at The Accountancy Partnership The reviews we receive from our customers show how hard we…

Read More

Accounting for Gift Cards

12th August 2025Gift cards can be a tricky concept to get your head around. Whilst it means cash for your business, it’s not actually…

Read More

UK Tax Rates, Thresholds and Allowances for the Self-Employed

11th August 2025Read our guide to UK tax rates and thresholds for sole traders, limited companies, partners and partnerships, employers, and other businesses. Paying…

Read More

What Happens if I Pay Tax in Two Countries?

10th August 2025Paying tax can be tricky if you’re a UK tax resident who lives, works, or earns an income outside of the UK,…

Read More

What’s the Most Tax Efficient Director’s Salary?

8th August 2025As a director you’re legally separate from your limited company even if you’re also the owner. This means you’re not allowed to…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.