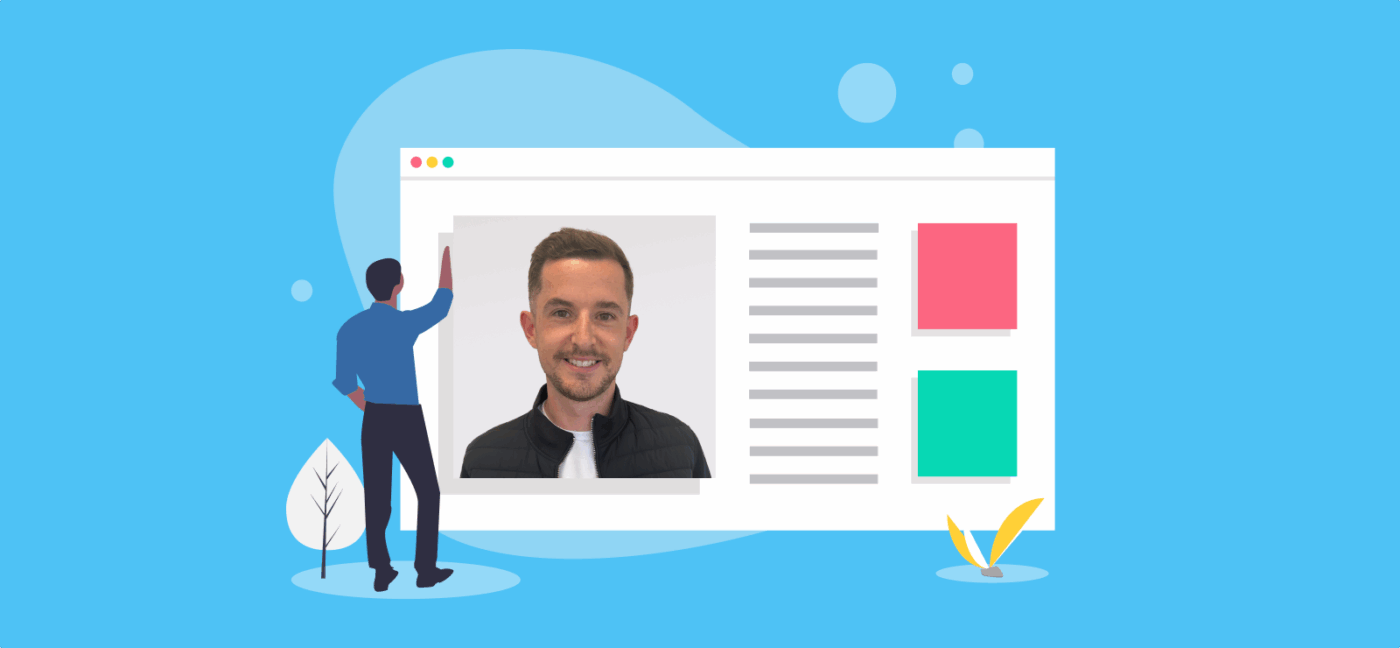

Staff Spotlight: Christopher Harrison, Accounts Manager

Give an overview of the duties, functions, and responsibilities of your job.

I’m one of the Accounts Managers. Prior to that, I worked as an accountant within the team; starting off as a Semi Senior Accountant before progressing to be a Trainer and Senior Accountant.

My day-to-day focus is ensuring my team is happy. This can range from help with their workload or support with any personal issues. Getting to work closely with my team is the best part of the role.

My role is hybrid, so I also have own client base which allows me to still prepare accounts and work with a variety of clients.

What is a typical working day like for you?

No day is ever the same, apart from a cup of coffee to start when I get in the office! I’ll log on and review my overnight emails and plan my day.

I combine my office duties along with accounts preparation, responding to emails as well as checking in on the team.

What particular challenges do you regularly encounter?

Working with a client portfolio there are multiple deadlines, be that for accounts or VAT returns, that need to be met to avoid penalties. At the same time, it is key that I am meeting clients’ expectations of our services. I have to be extremely organised, and plan my day to ensure I always meet both objectives.

What are some of the biggest challenges faced by your clients?

When clients are setting up their businesses it can be easy for them to concentrate on the day-to-day operations, and not pay attention to their accounts.

If left too long, this can become overwhelming as deadlines creep ever closer. This can create stress and confusion for clients.

I look to assist clients in every step of the process, assuring any questions are answered straight away, and that we understand how we are going to proceed. I always say to clients that no query is ever too small.

How are you able to use your skills to solve problems for them?

I have worked in accounts since 2017 and prior to that I worked within pension administration. I draw on both my knowledge from my studies and practical experience from my roles to resolve clients’ problems.

What is your favourite part of the job?

Working with my team and also with a wide range of clients. It is really interesting, learning about the clients and their businesses. It’s great when a client contacts me when they are unsure of something, and I am able to not only resolve their queries but also help them understand why we are doing this.

What do you like most about working for The Accountancy Partnership?

My colleagues! I have been at TAP since 2021 and I found everyone so welcoming from day one! I know that if I need it, the support is there for me. Everyone is so approachable.

We’re well looked after, too. We’re treated to smoothies and lunches, and they are amazing! Quarterly nights out are also an opportunity to socialise with my colleagues outside of the office.

What skills do you find most useful to do your job?

Communication and empathy. Each client works differently, so understanding what works best for them is key. Clients look to us for advice and guidance, so it’s important they fully understand the process. It also ensures we build a working relationship with the client, because it helps them.

Where’s your favourite place to visit on days off?

Chester Zoo. As a family it is lovely to spend time there seeing the animals.

Tell us about your proudest achievement.

I am proud to have gained my MAAT qualifications, it feels an achievement as I continue with my studies.

My overall proudest achievement would be my daughters Emilia & Rosie. The lack of sleep to start with has been well worth it, they are both little characters now!

How would your colleagues describe you?

If I maybe rephrase this to ‘how would you hope your colleagues describe you?’, I would like to think I am considered a team player. I treat people how I would like to be treated, and if I can help, I will. I hope that comes across in the office.

What are you reading/binge watching at the moment?

When I’m not reading the quarterly Accounting Technician magazine or looking at TAP’s guides and tutorials, I have a bit of time to watch TV…! Really it’s any football or golf.

Who do you admire, and why?

My wife. She is super supportive and really is the pillar of our family!

Being a big football fan, I do admire Jordan Henderson, the Captain of Liverpool Football Club. He comes across as the ultimate professional, dedicated to his sport. During the COVID crisis he was highly influential in bringing players together to donate funds to Charity.

What question would you really like to answer, and what’s the answer?!

I wish I could ask all sorts! BUT, when it comes to scones, is it cream then jam – or jam then cream? For me, it has to be cream then jam!

Find out more about the services we offer by hitting the live chat button, or get an instant quote online. Interested in joining the team? Check out our recruitment page!

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

What’s the Best Business Structure for a Contractor?

5th March 2026Independent contractors, consultants, or freelancers are self-employed individuals who work for businesses, usually on a short-term basis. Hiring a contractor enables firms…

Read More

Do I Need Self Assessment or MTD Income Tax?

4th March 2026Making Tax Digital is changing the way sole traders and landlords report income they receive from self-employment and property. It means the…

Read More

Accounting for Cash Payments in UK Businesses

3rd March 2026Card machines, Apple Pay, and bank transfers may be the norm these days, but cash is far from dead. This blog breaks…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

MTD IT Quarterly Updates

Your final, end of year MTD Income Tax submission is included in your fee, without this add-on service.

We would recommend you submit the quarterly updates yourself using Pandle or alternative bookkeeping software.

However, if you would prefer us to submit these quarterly updates for you, there is an additional fee of £35.00 per month.

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.