The Payroll Changes Guide April 2020

The UK government are rolling out changes in April 2020 which affect staff pay and PAYE. These updates might have an impact on how much you pay your staff, or how you deal with tax and National Insurance for contractors. Read our guide to changes affecting payroll in April 2020.

What will change for payroll in April 2020?

There are two important changes which come into effect in April this year. One of these is an increase to the minimum amounts that employers can pay their staff. Both the National Living Wage and the National Minimum Wage are going up. Effectively, it’s giving a pay rise to those who receive it.

The other important update is the ongoing rollout of IR35. Rules about off-payroll working are already in force for the public sector. As of the start of the new tax year, they will also be applied to private businesses where services are provided on or after 6 April 2020 (rather than when the payments are made).

If you employ staff paid at NLW or NMW, or if your business regularly uses the services of contractors, read on!

What is the National Living Wage in 2020/21?

The National Living Wage (NLW) is the minimum amount which employers must pay to staff who are aged 25 and over. From 1st April 2020 the statutory amount will go up from the current rate of £8.21 an hour, to £8.72 per hour. The rates change every April so it’s not too much of a surprise, though this is a bigger step up than normal!

What is the National Minimum Wage in 2020/21?

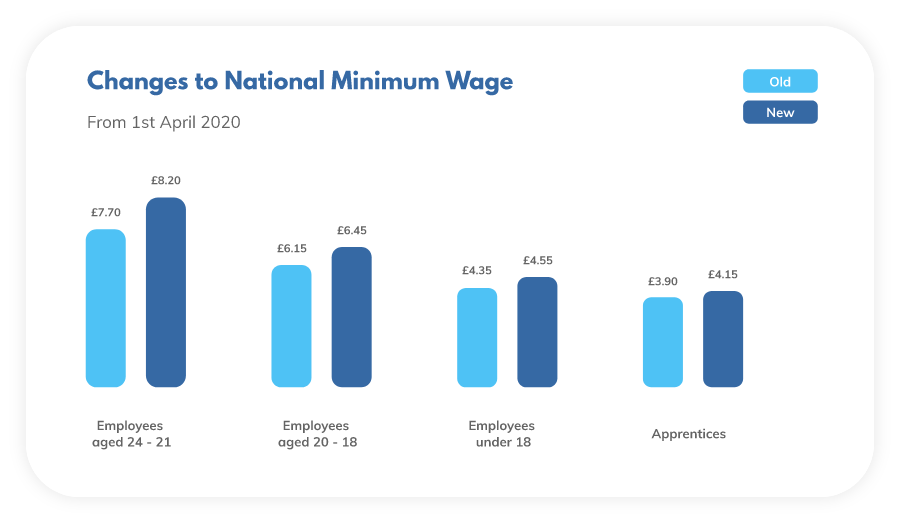

The National Minimum Wage (NMW) rate depends on the age of your employee, though they must be at least school leaving age. If they are an apprentice then the rate is different again.

Like the NLW the changes come into effect on 1st April 2020, though the size of the increase varies.

- For employees aged 21 to 24 the National Minimum Wage will increase from £7.70 to £8.20 per hour.

- Employees aged 18 to 20 will see National Minimum Wage increase from £6.15 to £6.45 per hour.

- For employees aged under 18 the National Minimum Wage will increase from £4.35 to £4.55 per hour.

- And finally, for apprentices the National Minimum Wage will increase from £3.90 to £4.15 per hour.

How will IR35 change in April 2020?

IR35 deals with self-employed contractors, freelancers, and the businesses that use them. At the moment the off-payroll rules only apply to contractors working with public sector clients, but from 6th April 2020 this will expand to include the private sector.

If you’re among the 71% of UK businesses who don’t know about the pending IR35 changes, read our article to find out what’s changing, and what action to take.

Talk to a member of the team about our payroll services by calling 020 3355 4047 or clicking the Live Chat button on screen.

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

Can a Sole Trader Have Multiple Businesses?

17th October 2025As a sole trader, you might well have more than one business. The good news is it’s absolutely fine to do so…

Read More

The Accountancy Partnership – Our Positive Reviews

15th October 2025We’re proud of our customer reviews here at The Accountancy Partnership The reviews we receive from our customers show how hard we…

Read More

Moving Your Business to the UK

7th October 2025Thinking about bringing your business to the UK? Whether you’re relocating from abroad or setting up a local branch, this blog breaks…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.