How Do I Make Someone Redundant in my Small Business?

Redundancies are never easy to deal with but unfortunately, they can be necessary. A shortage of work or a role which is no longer required can sadly lead to staff cutbacks in the workplace.

To ensure staff are treated fairly, and to reduce the risk of finding yourself caught up in a costly tribunal process, it’s important you follow the appropriate steps when making any redundancies.

What alternatives are there to redundancies?

Making someone redundant isn’t always the only option available. In fact, you’ll need to demonstrate this is a last resort having considered all other legitimate options – you may be asked to explain your process regarding this.

Flexible working or reduced hours

Sometimes employers make staff redundant due to reduced workload, only to experience an upsurge a few weeks later. Instead of redundancy, perhaps consider offering employees fewer hours or flexible working.

Employees who work full time might actually like the opportunity to work part time, especially if it means keeping their job.

Alternative employment

You could offer your employee a position elsewhere in the business if they’re suitable for the role. This can help you keep hold of good employees too. Just a few things to bear in mind when offering alternative employment:

- Alternative roles must be offered to employees on maternity leave first

- A fair process must be followed for other employees interested in the role – for instance, an interview process

- The alternative role must be offered before their current contract finishes, and must be offered in writing

- They should not have to apply

- The employee should be offered a 4-week trial period for the alternative employment, to ensure it’s right for them

Employees can refuse the alternative employment, but they must have good reason for this. For example, if it would mean taking lower paid work, there are travel restrictions, or they’re unable to do the job due to a health condition.

If they don’t agree but the reason is invalid, you may be able to refuse their redundancy pay. Just make sure that you can prove that their reasons aren’t valid.

Who should I make redundant?

This depends on the needs of the business, and what you’re trying to achieve. For example, if you’re looking to cut costs, you might focus on roles which aren’t profit-making.

If there is one person in a standalone position and the role is no longer required, it’s fairly straightforward. When there are two or more people in the same role, or similar roles, you must put them in a redundancy pool. This is the group of people being considered for redundancy, and the group from which you will make your selection.

Selecting staff redundancies

You will need to devise a fair way of selecting employees for redundancy. This can include considering attendance and disciplinary history, work performance, experience, and skills.

It’s also important that you’re extremely careful to only select employees for redundancy using factual data. Employers cannot choose someone for redundancy based on protected characteristics or unfair criteria, such as:

- Age

- Race

- Religion

- Sex or sexual orientation

- Disability

- Gender reassignment

- Marriage and civil partnership

- Pregnancy or maternity

- Family leave or time off relating to dependants

- Acting as an employee or trade union representative, or membership of a trade union

The reasons for selecting someone for redundancy must be based on facts and logic – the outcome of an employment tribunal could prove costly otherwise.

When do I need to tell staff about redundancies?

If you’re considering one person for redundancy and they’re in a standalone position, you can skip to the individual consultation.

However, if you’re making several people redundant, and they’re not in standalone positions, you will need to inform them they’ve been selected as a potential candidate for redundancy.

You can also ask your pool of candidates if they would like to take voluntary redundancy. Some workers may take this up, especially if they were already thinking of leaving.

It’s essential that you give those in the selection pool plenty of notice about the upcoming redundancy process. You should also follow this up with a letter to those affected.

What is the process for making someone redundant?

You must consult with any at-risk roles before making someone redundant, and keep them updated throughout the process. We go into more detail below but this will generally include:

- Tell employee their role is at risk

- A first consultation meeting: Conduct individual meetings with each employee considered for redundancy and ask for their comments

- Score employees against your selection criteria and consider any alternatives discussed

- Second consultation meeting

- Make the final decision

- Inform staff, give notice, and calculate redundancy pay

First consultation meeting

Invite those being considered for redundancy to an individual consultation meeting, and ask for their comments. They have the right to be accompanied at this meeting; either by a trade union rep or a colleague from the workplace.

The meeting is also an opportunity to discuss voluntary redundancy, and for employees to voice any concerns about the selection criteria, or suggest alternative options. A fresh perspective can generate good ideas, and might even help avoid redundancies.

Remember to take notes throughout the meeting; you may need to refer to them later on.

Score employees against the selection criteria

Use factual information to score employees against the redundancy selection criteria. The data might come from performance and HR records, and you might also consider any information provided during the employee’s consultation meeting.

It’s important to consider the data from every angle. For example, if you base your decision on attendance, has the employee discussed a legitimate reason for being absent, such as a documented illness?

Second consultation meeting

The second consultation is an opportunity to discuss an employee’s score with them, and to amend it should they raise any valid points during their consultation.

Final consultation

At this stage, you will need to let your employees know whether or not they have been selected for redundancy. Those that are selected must be given a letter confirming this, as well as other details such as their notice period.

If you are requesting that the employee works their notice, you must also try to find alternative employment options. Obviously, this is more difficult to do in small businesses, but in a large organisation there may be other roles on offer.

Can employees appeal against redundancies?

Employees do have the right to appeal a redundancy decision if they feel the process or decision is unfair, and this should be made clear in the redundancy letter you provide. You can arrange a meeting with them (and anyone they wish to accompany them) in order to discuss their appeal.

Accepting or rejecting the appeal

If you accept their appeal and the employee is on their notice period, you can simply cancel the redundancy. They’ll continue working on the same contract. You could choose to re-hire them if they’ve finished working their notice period. This will still be considered as ‘continuous service’ though they won’t have the right to redundancy pay if they’re re-hired.

If you reject the appeal, the redundancy continues as normal. Whatever the decision, confirm everything in writing!

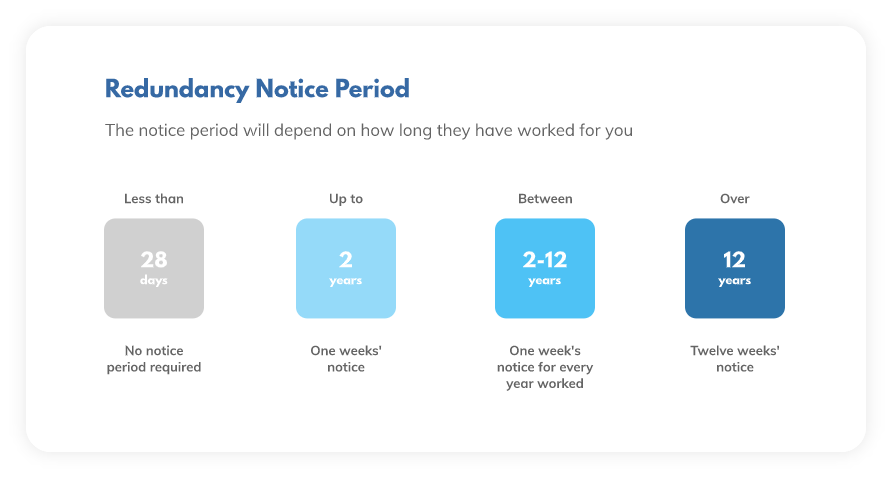

How long is the redundancy notice period?

If staff have been employed for less than one month, then you’re not required to provide a notice period. The statutory redundancy notice period is one week for employees who have been employed between one month and two years.

If an employee has been employed between two and twelve years, they are entitled to one week’s notice for every year they have worked. Staff who have been employed for more than 12 years are entitled to 12 weeks’ notice.

You can also end someone’s employment without notice, and provide ‘payment in lieu of notice’. This should include the basic pay, contributions and any benefits included in the employee’s contract that they would have received during the notice period.

How much is statutory redundancy pay?

Employees are only entitled to redundancy pay if they have worked with you for a minimum of two years. HMRC’s online tool for calculating statutory redundancy pay considers:

- The employee’s age

- Their average weekly pay for the 12 weeks leading up to the date of the redundancy notice

- How long they have been employed by you

Do employees pay tax on redundancy payments?

An employee who is made redundant may receive a ‘termination payment’ which can consist of statutory redundancy pay, as well as other things such as unpaid wages or holiday pay.

The first £30,000 of combined statutory redundancy, additional severance (if you offer an enhanced redundancy payment), and non-cash benefits are not subject to tax.

Other amounts included in the termination payment might be subject to tax. For instance, if the employee is entitled to bonuses, or has holiday pay and unpaid wages owed to them.

Learn more about our online accounting services for businesses. Call 020 3355 4047 to chat to the team, and get an instant online quote.

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

Estate Planning for Family Investment Companies

12th February 2026If you want to pass your wealth and assets on to the next generation, a Family Investment Company (FIC) could be an…

Read More

Do Influencers Pay Tax?

11th February 2026The occupation of ‘influencer’ or ‘content creator‘ is more popular than ever, but there isn’t much information out there on how to…

Read More

Things to Consider Before Making your Children Shareholders in your Limited Company

10th February 2026Passing shares to children is a common way for family businesses to plan ahead. It can help children build long-term assets and…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

MTD IT Quarterly Updates

Your final, end of year MTD Income Tax submission is included in your fee.

You can submit the quarterly updates yourself using Pandle, or alternative bookkeeping software (which we recommend).

However, if you would prefer us to submit these updates, there is an additional fee of £35.00 per month.

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.