How Do I Start an Ecommerce Business Online?

Now more than ever, businesses are going online to sell their goods and services. Often it can make perfect sense: no expensive premises to pay rent and maintenance on, no large overheads, and the flexibility to sell to people all over the world at any time of day or night. But, getting started online can be daunting with plenty of practical and financial considerations to tackle.

What is eCommerce?

eCommerce (the ‘e’ stands for electronic) simply refers to the practice of buying and selling goods and services online in exchange for money.

How do I start an online business?

Pretty much anyone can start a business online with very few technical skills needed. Online entrepreneurs are popping up everywhere, with new ideas and dynamic ways of selling their services or products.

Sadly, throwing together a website, setting up a few social media pages, and creating a smart logo, isn’t going to make you a millionaire (although you might be able to launch it as a hobby side-business). So, what should you do to start an online business?

Be clear on your objectives

What is it you want your online business to do? In other words, are you simply selling products for a profit, or are you looking to raise awareness of something?

Plan your resources

You may not make money straight from day 1. Building your customer base and turning a profit can take months – even years. With this in mind, make sure you can manage financially in the meantime, either via alternative employment, savings, loans, investment, grants, or other income.

Know where you’ll store any stock

If you’re offering a service, such as copywriting, you probably won’t have any specific stock to worry about. But if you’re offering a practical trade or selling goods online, you’ll need to consider how you’ll source and store tools, materials, and stock. That said, even service-based e-commerce businesses need somewhere to operate from!

Decide which online sales platform will work best

Even if you’ll be selling entirely online, you don’t necessarily need a website of your own. Online marketplaces (like Amazon, or Etsy) allow you to set up your own shop on their platform, and use their payment processing systems to manage your sales.

Bear in mind that some platforms are better suited to certain types of products than others. For instance, Etsy is great for handmade goods, whilst People Per Hour is better for freelancers providing short projects.

There are lots of advantages, including better security, and a simpler route to potential customers who search the platform for products or services likes yours.

Building an online business with credibility

Your online business starts the moment you begin building your website or online store, not when it goes live. Before you start, research who your competitors are and what is working for them. You could even trial what the buying experience is like from their website or shop, and see how you can improve it.

Whether you’re selling products through a website, or providing a digital service, it has a better chance of success if it looks trustworthy and well designed. As consumers and service-users we’re primed to trust providers which look more presentable. You can improve your online reputation by:

- Making sure your website has a security certificate (such as SSL) so that visitors don’t see security warnings.

- Offer different payment methods/ways to sign-up/book you. This lets customers use the method they feel most comfortable with.

- Inviting customers to leave reviews across a variety of review sites. This means other potential customers can research you, see what you’re good (or bad!) at, and how you deal with issues.

- Provide different contact methods – again, so that customers can choose the one they feel most comfortable with. It also reassures buyers that they can contact you if something goes wrong.

Whilst opening a physical shop on the high street gives you natural visibility from passing traffic, the same isn’t true about launching a website. To help things along you might use online adverts through a search engine or on social media, or position yourself as a result for relevant searches (known as SEO). If digital marketing sounds overwhelming, take a look at our guide to learn more.

What practical and tax considerations are there when setting up a business online?

When you’re planning your eCommerce strategy, you’ll need to plan for things like order fulfilment, postage and packaging, marketing, and tax.

How will you market your product or service?

Having a really clear and logical marketing strategy that both you and your customers understand is what makes the difference between putting up an online shop, and it actually making any sales. Think about who you’re selling to, and what is most likely to attract their attention. IT’S NOT ALWAYS ABOUT BEING THE LOUDEST VOICE.

What your payment and delivery options will be

What steps will your customers take in placing an order with you? You also need to determine how you’ll work out your delivery costs and whether you’ll pass these on to customers or not. If you’re selling to customers abroad, make sure you’re clear on any customs and excise duties too. Your pricing strategy is a key part of this, so again, do lots of research.

What tax you’ll need to pay

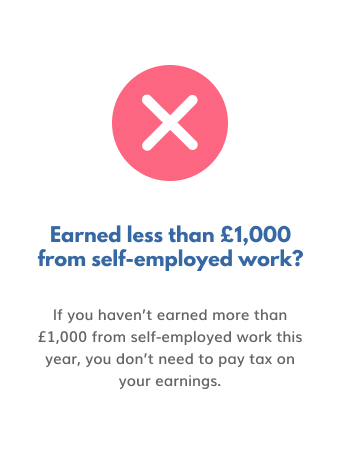

Once you’re selling products or services online, and making more than the £1,000 Trading Allowance from it, you’ll need to inform HMRC and pay any tax due.

HMRC considers most types of online selling as a trade. So, if you’re doing any of the following, you’re highly like to need to pay tax:

- Making a profit (rather than simply selling to raise emergency funding or selling for fun)

- Modifying products to generate a higher profit

- Selling items for similar prices that other retailers are selling them for

- Carrying out lots of similar transactions across a short period of time

This isn’t an exhaustive list but as a general rule of thumb, make sure you seek professional accountancy advice if you’re not sure.

How much tax will I have to pay as an online business?

This depends on several things, including how much money you’re making and whether you’ve exceeded your personal tax allowance for the year. What type of tax return you need to submit depends on how you have structured your business.

Income Tax

If you’re employed, the organisation you work for will deal with your tax for you which will show on your payslips. However, if you sell online for your own business, that income will be classed for tax purposes as self-employed (even if you’re also employed elsewhere at the same time).

Self-employed income needs to be reported to HMRC. Just so you know, you may not need to pay any tax on the first £1,000 of self-employed income that you earn in a tax year. This is due to the Trading Allowance, and is great for micro businesses in particular. It’s a form of tax relief (one of many which we cover in our article Tax Relief for the Self-Employed).

National Insurance

Paying National Insurance contributions means you can access a UK state pension as well as other benefits. How much you’ll need to pay depends on whether you’re employed or self-employed, what type of business you’re running and if you’re employing any staff.

Corporation Tax

If your business is set up as a limited company, you’ll need to submit a Company Tax Return each year.

VAT

The standard VAT rate in the UK is 20%. However, some products and services (such as electricity, gas, or heating oil for domestic and residential use or for non-business use by a charity) are charged at 5%. Children’s clothing is charged at 0%.

If your business has a turnover of more than £90,000, you’ll need to register for VAT, and submit regular returns to tell HMRC about the VAT you charge on sales and pay on purchases.

You can voluntarily register for VAT early if you want to, but once your VAT-taxable turnover goes over £90,000 in a 12-month period (or if you expect to within the next 30 days) it’s mandatory to sign up as soon as possible.

VAT-registered businesses now also keep digital tax records and submit VAT returns using special software. You may find our online guide to Making Tax Digital for VAT useful here.

Thinking of setting up an online business? We’re an online service, too! Learn more about our online accountancy services for businesses. Call 020 3355 4047, or get an instant online quote.

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

April 2024 Client of the Month: Pro-Logist ltd

23rd April 2024This month we spoke to Silvia, Managing Director of Pro-Logist ltd! Pro-Logist ltd | LinkedIn Hey Silvia! Tell us about your business Pro-Logist,…

Read More

The Self-Employed Guide to Retirement Planning

19th April 2024Pension planning is often something we forget about until later in life, but the earlier you think about it, the better. Everyone…

Read More

14 Accountancy Terms Explained for Startups

17th April 2024Starting a business can be complicated enough, especially with all the new lingo that crops up along the way. In this article…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.